7 Common Myths About Blockchain

Common Blockchain Myths

Blockchain is a versatile technology, and while it may not be a one-size-fits-all solution, the vast majority of supposed drawbacks stem from misunderstanding how it works.

The most common mistake is that people tend to oversimplify issues that some blockchain solutions face and then apply that to every blockchain. In a similar vein, the best way to see through these myths is through self-education. Here, we will list the seven most common myths plaguing the nascent technology, as well as explain why they are not true.

Energy Consumption

Myth 1

Blockchain’s well-documented advantages compared to similar technologies are sometimes not enough to persuade a layman to give the technology a try—mainly owing to persistent myths that are only partially based in reality.

One of these common misconceptions is that blockchain, as a rule, uses a lot of power and is therefore too expensive or even irresponsible for most. The truth is slightly more complicated, but also more favorable towards those who would choose blockchain for their business needs.

Where the Myth Comes From

Due to Bitcoin being the best known blockchain, many believe that the issues Bitcoin have are the same for every blockchain application across the board. It is true that Bitcoin is very computationally heavy—its annual energy consumption is estimated to be more than 75 TWh, which is comparable to the power consumption of Chile—but Bitcoin is only one blockchain-based project. Its power usage stems from the fact that it uses a consensus algorithm called Proof of Work (shortened PoW), which requires miners to submit proof that they’ve done the required work, as the name implies, in order to collect their reward before anyone else can beat them to it.

.png?width=1200&name=Copy%20of%20TWIBC%20%234%20Blog%20(1).png)

In other words, PoW is a very competitive algorithm. Every solved puzzle is one block added to the blockchain; Bitcoin receives a new block every ten minutes and the algorithm adjusts itself in case this happens sooner or later than expected, by tweaking the difficulty level of the puzzle. This means that a huge number of highly specialized mining tools are exerting incredible amounts of power to solve the puzzle and collect the attractive reward (which was 6.25 BTC as of the time of writing).

What Are The Alternatives?

Proof of Work is very inefficient in terms of energy consumption, beyond doubt. However, it is far from the only consensus algorithm currently in use. A major competitor is Proof of Stake (PoS): a concept that states that a person can either mine or, more commonly, validate block transactions according to the amount of cryptocurrency they hold. In other words, a participant’s power is directly proportional to their native cryptocurrency holdings in any given network—not unlike company shareholders. The more cryptocurrency a participant stakes, the more likely they are to be chosen to validate the next block and therefore receive the transaction fees included in that block. Should they want to cheat, however, their stake is forgone. In other words, the power consumption point becomes moot in the case of PoS: it is simply not relevant to the network’s functioning.

Proof of Stake is not just a potential alternative to Proof of Work: it was first implemented in 2012 with Peercoin and has since become the basis to many blockchain platforms. One of them is Ethereum (its native cryptocurrency ETH is second only to Bitcoin in terms of market capitalization): although it is still based on Proof of Work, it has begun the laborious process of switching to the energy efficient Proof of Stake. Another public example is Polkadot, a platform that has gained popularity within the past few years for its next gen ideas.

.png?width=1200&name=Proof%20of%20stake%20Blog%20(1).png)

It’s important to understand, however, that consensus algorithms as a rule exist only because these blockchains are public and strive to offer equal access to everyone. They’re there to make sure nobody is getting unfair treatment, be it positive or negative. When a blockchain is private, the owner(s) can set the rules which determine who has what kind of access.

This means that enterprise-level users often have nothing to worry about: this side of the technology is handled by the blockchain service provider. They will not use Proof of Work as a rule: this algorithm is only suited for decentralized networks that favor security, accessibility and fairness above energy consumption. In the less likely case that the customer needs a specific highly distributed consensus algorithm—they will usually be able to choose between a number of energy-efficient algorithms. Proof of Stake is only one of them; others include Proof of Authority, Proof of Elapsed Time, etc.

What Can I Do?

If energy consumption is your biggest obstacle when it comes to potentially implementing a blockchain solution into your business, then you can rest assured that it is much less of an issue than you may have thought. Blockchain solutions geared towards enterprise-level customers are often far more advanced and adaptable than their public counterparts, in part because they expect far less traffic, along with more specific use cases.

Not only is the energy consumption of permissioned blockchains lower by many orders of magnitude than that of PoW-based systems, it can also be further decreased by having blockchain be part of a hybrid solution in which on-chain workflows are decreased to a minimum. A research paper by Sedlmeier et al. (The Energy Consumption of Blockchain Technology: Beyond Myth) additionally states that in some instances, such as supply chain, the energy consumption of blockchain is still a massive improvement to the carbon emissions caused by the current system, which often includes a huge paper trail and generally slow and laborious processes.

This means that weighing the pros and cons of using a blockchain solution compared to what you already have is a solid first step towards deciding whether it will work for you. The second step is choosing the blockchain provider you like the most and addressing any energy consumption concerns with them, as they will be able to give you detailed answers pertaining to your specific case.

Speed

Myth 2

For many businesses, agility and the ability to respond quickly to the market are essential to running a successful business. Integrating what may appear to be a complex technology on the surface such as blockchain, may seem like a step in the wrong direction.

However, the idea that blockchain is slow is yet another myth born out of a public blockchain (Bitcoin and Ethereum, for example) that has already been addressed by enterprise-grade blockchain providers. A private, permissioned blockchain created specifically for your needs does not have to be a snail-paced technology.

Why Is Blockchain Slow?

Let us first address the origin of the myth. The Bitcoin scalability problem is one of the best-known issues the network faces. Bitcoin’s throughput comes up to seven transactions per second. The reason for this is that Bitcoin is decentralized (as are most other public blockchains). To keep the network safe and healthy, its creator trades-off decentralization against throughput.

But, Bitcoin is only one blockchain. Arguably, it is now being treated as a digital commodity rather than the e-money it was originally intended for. Ethereum, in comparison, is the most widely used network for its programmability, from decentralized applications (D’Apps) to decentralized finance (DeFi). It is much faster than Bitcoin. While Bitcoin's block time is around 10 minutes, Ethereum's is seconds. Additionally, Ethereum is moving from a Proof of Work consensus algorithm to Proof of Stake (find out in Blockchain Myths: Energy Consumption), which is set to boost its transaction speed, along with many other improvements.

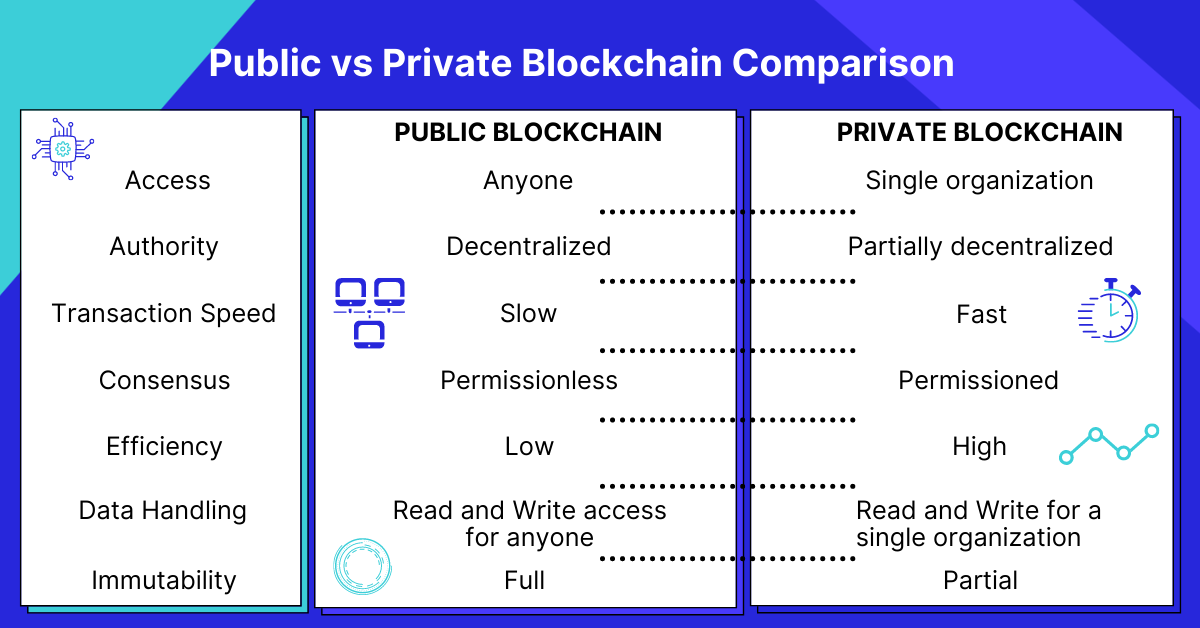

Public & Permissionless vs Private & Permissioned

It's important to note, that both Bitcoin and Ethereum are public and permissionless blockchains. In other words, anyone can participate in the network. This is one of the reasons why they’re relatively slow and inefficient when compared to other technologies. To keep in line with their decentralized nature—some tradeoffs had to be made.

When it comes to blockchains that are used by businesses, the private and permissioned blockchain platforms can be made significantly faster than their public counterparts. This is simply because there is a smaller number of participants on the network. Hence, unlike public blockchains, there is no need to accommodate thousands or even millions of users while ensuring that everyone is treated fairly and equally.

Resources permitting, all major private and permissioned blockchains are capable of handling thousands of transactions per second. But public blockchains are not too far away from this either: several scaling solutions are attempting to solve this issue. In the debate of public vs private, when it comes to enterprise-grade use, it comes down to the amount of control you require for the network via permissioning and privacy. Using public blockchains means you have to play by the same rules as everyone else, including being held up during periods of high network activity. Since access to a private and permissioned network is much more limited (even if you share it with other businesses or several branches of your own company), you can expect better performance consistently and know that you are in control of the network.

Enterprise Blockchain Speed

It is very difficult to pinpoint the exact speed of each enterprise-grade blockchain provider’s product. There’s a significant difference between what the network can potentially handle and what is realistically possible— a lot will depend on your requirements.

For example, a significant factor in the speed of your blockchain network is the number of nodes providing consensus on the network. As a rule of thumb, the more nodes you have, the lower your throughput. But, this is only one aspect, speed will ultimately depend on things such as:

- Where the nodes are physically located

- The node hardware

- Whether you are using only blockchain or a hybrid solution of which blockchain is only one part

- The block size and frequency

- The size of transactions

- The complexity of the integrated smart contracts

Instead of allowing everyone the same access, you can also set who is permitted to change things and who can only view the recorded data. This brings the number of permissioned participants down even further. However, much like the case with the public networks, you ultimately end up sacrificing decentralization and/or control against performance. The right balance for your specific use case needs to be struck.

Like all pervasive myths, blockchain myths also have some basis in reality. While the technology is, on average slower than other databases, enterprise-grade solutions are definitely not as slow as public and permissionless networks and can be made faster depending on your personal needs and circumstances.

Free eBook

Simply enter your details and we'll email our Principles of Successful Blockchain Deployments eBook straight to your inbox!

Free eBook

Simply enter your details and we'll email our Principles of Successful Blockchain Deployments eBook straight to your inbox!

Data Visibility

Myth 3

Public blockchains like Bitcoin depend on data visibility as a source of transparency. As the networks are mostly pseudonymous, the ability to trace each transaction back to its origin significantly narrows the space for malicious acts. This is not the norm.

Some public blockchains value privacy above all other considerations and implement technological solutions to that end. Whereas private and permissioned blockchains are highly adaptable to the needs of their users. In other words, your data does not have to be visible to the general public if you do not want it to be.

Origins of the Myth

One of Bitcoin’s biggest attributes is its decentralized nature. By removing a central authority that controls the blockchain, its creator wanted to adopt a more democratic approach. Not only would the playground be more equal, but the network would also be more secure, as there is no single point of failure for the system. This is also where data visibility comes in. By knowing what data comes from each participant in the network, malicious acts are quickly recognized and offenders penalized. This ensures the health of the network. Without a central figure to police it, it's in the best interest of all participants to work together.

However, this does not completely strip away any privacy the users might have. Bitcoin is pseudonymous: you do not have to provide your details to participate. But, transactions can still be traced back to your node (and even possibly to your identity, if you haven't been keeping it safe). Participants have to be able to protect their identities, but not to the point where malicious actors can get away with harming the network, so the balance is precarious.

Public Network Anonymity

As Bitcoin’s pseudonymity showed its disadvantages through the years, users decided to give anonymity a shot by employing advanced cryptographic solutions. Zero-knowledge proofs are one such technology. This is a highly complex way in which Alice tells Bob that she is in possession of certain knowledge without disclosing the knowledge. The complexity stems from the fact that Alice’s knowledge has to be provably correct without Bob ever knowing exactly what it is.

An example of zero-knowledge proof in action comes from the Zcash network. The protocol is called a zk-SNARK (short for Zero-Knowledge Succinct Non-Interactive Argument of Knowledge). “Succinct” means the verification takes a few seconds. “Non-Interactive” means that there's no need for the two participants to communicate beyond the first verification message.

.png?width=1200&name=Blockchain%20Myths_%20Data%20inline%20Blog%20(1).png)

However, Zcash only employs this technology in shielded transactions, as it is very computationally heavy. Transactions are not shielded by default. In some cases, unshielded transactions have been known to leak data about shielded ones. As with most issues, there is a certain give and take, no solution is perfect when it comes to public blockchains.

Private Network: Privacy at the Forefront

Private and permissioned blockchains are another matter entirely. Without the different considerations that are innately tied to public blockchains, such as wide public access and transparency, there is none of the aforementioned give and take. In other words, there is no need to ensure that everyone gets equal access to the blockchain without compromising their privacy, as the owner sets the permissions according to the company requirements. There is no need for the data to be visible to anyone but the people at the company. Even then, the owners can decide who gets to see what.

The only potential exception to this rule would be if your blockchain solution were oriented towards the public and open to public use. Even then, however, you would not be required to keep the data visible to everyone. As already discussed, this is part of decentralized and unregulated blockchains that need to ensure the network stays healthy. If you can offer this through other means, data visibility could simply be a perk and not a requirement.

How Enterprise-Grade Blockchain Providers Approach Privacy

The three main enterprise-oriented blockchains and their providers, Hyperledger Fabric, R3 Corda, and ConsenSys Quorum, all have private and permissioned blockchain at their heart.

Hyperledger Fabric employs four different privacy measures:

- Asymmetric cryptography & zero-knowledge proofs used to separate transaction data from on-chain records.

- A digital certificate management service vouches for the legitimacy of your company.

- Their multi-channel design protects information from being shared across different channels.

- Privacy data collection serves to protect the data of different companies using the same channel.

ConsenSys Quorum has three main features when it comes to privacy:

- A private transaction manager called Tessera serves to store encrypted transaction data.

- A secure enclave is used to handle most of the cryptographic work, including holding private keys, but is isolated from the other components for security reasons.

- Public and private states that impose restrictions upon who gets to handle which transaction, depending on whether they are authorized to do so.

R3 Corda handles privacy in the following ways:

- Partial data visibility signifies that transactions are not globally broadcast.

- Transaction tear-offs mean that transactions can be signed without being completely visible to all parties.

- Key randomization is used to prevent any key being tied to one identity.

- Graph pruning means that old asset data can be “pruned” from the new version of the asset, so the new version does not allow anyone to follow its history back beyond the point of the pruning.

- Global ledger encryption is their main privacy effort—as its name implies, this keeps the entire ledger encrypted.

With all three platforms, not only is the data hidden from the public via a private network, but you also get to decide who gets access to which parts of the blockchain and how much they can see. In other words, data visibility and access are controlled.

Protecting their company’s sensitive data is of great importance to any manager. Blockchain does not have to be a compromise between that and the improvements it brings to the table, as long as you choose a private and permissioned blockchain instead of a fully public one.

Cryptocurrency Use

Myth 4

Bitcoin may be your first association when thinking about blockchain. However, it is not the technology’s only purpose. Public networks have to use coins to function, but private and permissioned ones are much more adaptable.

We will explain how coins work, what their purpose is, and why your blockchain platform most likely does not need them at all.

Why Do Public Blockchains Need Tokens?

Blockchains were envisioned as self-incentivizing places. Even for something as simple as sending something from one user to another, a network fee is paid to the participants, or nodes, who keep the blockchain up and running, either through mining or staking. In the Ethereum network, gas is the execution fee for every operation from a transaction, to triggering a smart contract. Its price is expressed in ether, the network’s native cryptocurrency, meaning that the two are not the same.

In Proof of Stake consensus algorithms, the amount of the network’s native cryptocurrency you use is directly proportional to your vote on the network's governance. In a way, this gives you the status of a “stakeholder”. Not only do you get to make decisions, but you are rewarded with the fees paid by other participants for doing your job well.

Tokens in Private Blockchains

There is one reason that is not reserved solely for public blockchains, however: the tokens’ purpose as assets. This is where the concept of tokenization comes in. Many businesses have decided that representing an asset through a blockchain token is a simple way of shifting their operations onto the blockchain. This helps prove ownership, track any changes, and enhance the security of the asset through cryptographic solutions. It also adds new ways to manipulate it through smart contracts.

.png?width=1200&name=Asset%20Tokenization%20Blog%20(1).png)

Of course, the asset does not have to be a cryptocurrency. While it is possible to have it trade publicly on cryptocurrency exchanges, this moves into security territory, covered by different financial authorities that depend on your jurisdiction.

Permissionless vs Permissioned

Another potential reason for introducing tokens into a private blockchain is if you’re using a permissionless model, for example when you intend to have it open for public use, or if you simply can’t predict who will be using it. Permissionless models mean that everyone has the same level of access to the blockchain. Tokens are often used as a way to determine who gets to make which kind of changes, by assigning a “cost” to each possibility.

Permissioned blockchains are the best choice for businesses that already have an established hierarchy, allowing the owner to set the permissions as required. Some participants will only be able to read the data on the blockchains, others will have varying levels of access to making changes depending on the company’s requirements. With this setup, there is no need for tokens to “unlock” the ability to make certain changes, nor is there any need to incentivize participants.

Using a Private, Permissioned Blockchain

Both Hyperledger Fabric and R3 Corda reach consensus at a transaction level. This means that there is no need for miners or validators thanks to their permissioned nature.

In the case of Corda, validity is ensured by checking for all required signatures, as well as ensuring that all transactions referred to are valid. Uniqueness is another important aspect required to reach consensus—to prevent double-spending, the system ensures that this transaction is unique.

For Fabric, since message flows are partitioned across channels, consensus is reached only at transaction level instead of the ledger level, as is the case with public blockchains like Ethereum. This means that with everyone holding this authority signing off on a transaction, there is no need for tokens they would use to cast their vote like in a public network.

ConsenSys Quorum does use the Ethereum framework, but it does not use gas for transactions as they do not participate in the public network but their private one. Again, there is no reason to touch the ETH cryptocurrency to be able to operate your own private, permissioned network based upon Ethereum.

To sum up, there is no need for your blockchain to use coins or tokens unless you prefer it for any reason. Cryptocurrencies are a large and valuable use case of blockchain technology, but they are far from the only one, nor are they inseparable from blockchain itself.

Industry Use

Myth 5

Blockchain is in use by most industries in some capacity. Refusing to try it because “nobody else is doing it” is needless.

Most established projects are using private and permissioned blockchains. Public blockchains tend to be less popular.

We’ll list some examples of blockchain adoption. These projects have live products that are actively being used. We list them by industry.

Tech

Many tech companies offer Blockchain-as-a-Service (BaaS). Among them are Microsoft, Oracle, and Amazon. They manage their service. Creating a blockchain is simple, and they handle the technical duties.

Accenture, Guardian Life Insurance, and Nestlé all use Amazon’s product. Microsoft’s Azure product has onboarded names like J.P. Morgan, XBox, and Starbucks. In the case of Oracle, customers include EverLedger, CargoSmart, and Neurosoft. Each provider offers some case studies of their customers. This can help other businesses decide to choose blockchain.

Banking

Blockchain has offered banking a chance to modernize. A common use case is central bank digital currencies (CBDCs). The Central Bank of The Bahamas launched the world’s first CBDC, called the Sand Dollar, in 2020.

They were not the first to pitch this idea. The Bank of England (BoE) pioneered the concept. They are researching the topic, but have not launched anything yet. Many other central banks have shown interest in CBDCs. These include banks in China, Canada, Sweden, Thailand, Venezuela, and Russia.

Insurance

The insurance industry suffers from slow and inefficient data sharing. This is what a blockchain solution called OpenIDL addresses. The project connects data across the American insurance industry. As its basis, it uses Hyperledger Fabric. It is capable of handling different insurance lines. They include auto, flood, homeowners insurance, and reinsurance.

In overseas shipping, A.P. Moller-Maersk has partnered with Microsoft for maritime insurance. The product is called Insurwave. It gives real-time visibility into ships, reducing insurance costs.

Supply Chain

With luxury goods, customers benefit from increased transparency. It ensures that the item is original. Plus, it can guarantee it is not the product of child or slave labor. When this data is on the blockchain, customers can just scan a code to see it. This can also help others in the supply chain keep track of everything. It eliminates paper trails and speeds up the process.

With luxury goods, customers benefit from increased transparency. It ensures that the item is original. Plus, it can guarantee it is not the product of child or slave labor. When this data is on the blockchain, customers can just scan a code to see it. This can also help others in the supply chain keep track of everything. It eliminates paper trails and speeds up the process.

Swiss software developer aXedras has a blockchain platform called Bullion Integrity Ledger. It tracks precious metals to ensure sustainability and integrity. It also helps protect human rights.

A.P. Moller-Maersk is making waves in the supply chain through TradeLens, as well. This is their blockchain platform used for tracking shipments. It handled more than a billion shipments in 2020 alone.

Healthcare

The COVID-19 crisis has left the world struggling to cope with a new normal. IBM has developed the Digital Health Pass to combat this. This helps users share their medical data with anyone who needs access to it. This includes employers, event organizers, travel agencies, etc. As every user controls their data, they maintain their privacy.

Pharmacy

Medicine must be diligently tracked, as this can save lives. Swiss drugmaker Novartis is leading the EU consortium PharmaLedger. They use blockchain to let customers access real-time data through scan codes. Behind the scenes, they are also tracking counterfeits and black markets.

There is a similar project in the US as well. The FDA has selected the BRUINchain ecosystem as part of a pilot project program in the pharma supply chain. The platform helps correctly dispense prescriptions while keeping track of expired or counterfeit drugs.

Government

The right to privacy in the internet age is evolving. This prompted the passing of the General Data Protection Regulation (GDPR) in 2018. “Part of that regulation was ensuring the storage and retrieval of data is 100% irrefutable,” Joisto says. The company developed a blockchain-enabled archive that ensures all data is immutable. It adheres to GDPR standards of data protection.

Gaming

Horizon is a blockchain infrastructure company working on innovating gaming. SkyWeaver is their flagship trading card game. It is free to play, with 500 unique cards and blockchain-ensured ownership. By creating decks, players can fight each other. SkyWeaver uses Ethereum ERC-1155 tokens as the basis of ownership.

Real Estate

Home rentals can be a laborious process that includes a lot of repetitive paperwork. The Japanese NEXCHAIN consortium is using blockchain to provide an end-to-end home leasing solution. Through one platform, users verify their identity, pay utilities, and view properties without an agent. With every relevant party sharing the same platform, the process is easier and faster.

Social Impact

Hala Systems is a project trying to save civilian lives in the Syrian Civil War. Their Sentry Early Warning System warns citizens of impending airstrike attacks. The solution saves hundreds of lives, and this data is important to report. By recording it on a blockchain, they can ensure it has not been changed. They can also report war crimes faster through the Ethereum public network.

Blockchain is an excellent solution for specific problems. You can find these problems in any industry, your own included. Do these use cases fit in with your business? Have our examples helped you recognize new options?

Mainstream Adoption

Myth 6

Blockchain “going mainstream” has been the talk of the industry for years now. But with its already significant footprint in many of the world’s biggest companies, the better question is, “Who hasn’t adopted it yet?”

One of the best examples for this is the annual Forbes Blockchain 50 list, where they showcase companies with a revenue above USD 1 billion that have already implemented the nascent technology, as well as how far along that implementation is. The article itself states that blockchain has gone mainstream, with 21 newcomers to the list proving that the number of high-profile blockchain implementations is steadily growing.

.png?width=1920&name=Forbes%2050%20infographic%202021%20(1).png)

Most of the listed companies use more than one blockchain platform, as many run several projects. Some—most notably the ones dealing in cryptocurrencies—only use public blockchains that host those coins. As we consider Hyperledger Fabric, ConsenSys Quorum, and R3 Corda the best enterprise-level blockchain providers, we will go through the different companies currently using them.

The enterprise-grade blockchain that was originally contributed by IBM and Digital Asset is by far the most popular on the Blockchain 50 list, used by a total of 24 businesses:

- A.P. Moller-Maersk handles both supply chain information and maritime insurance through blockchain.

- Ant Group has more than 50 blockchain applications in various stages on AntChain, their proprietary blockchain platform.

- Baidu has more than 20 blockchain solutions—one of them serves as a way to handle copyright disputes.

- BHP uses the technology mainly for supply chain information.

- Boeing has an air traffic control system for drones based on blockchain.

- Carrefour, the French supermarket chain, tracks several food items through blockchain to let customers check the origin of their produce.

- China Construction Bank uses blockchain to help borrowers get their loans, but also identify risky borrowers.

- CONA Services intends to move all orders and shipments between different Coca-Cola bottlers to the blockchain.

- Daimler is applying blockchain to several areas, including fundraising.

- Depository Trust & Clearing Corporation (DTCC) has moved USD 11 trillion of credit derivatives to a blockchain.

- Honeywell keeps 2 million aviation quality documents on the blockchain to make them more accessible to their users, along with selling used aviation parts on a blockchain-based marketplace.

- HSBC uses blockchain to improve the flow between its global branches.

- IBM Corporation has a Digital Health Pass application that allows people, such as event organizers, to check an individual’s Covid-19 results before letting them in.

- ICBC: with a total of 30 blockchain applications, the bank uses the technology to let customers track the data stored on it.

- ING Group helps several different financial authorities check whether crypto assets comply with AML standards.

- Nornickel is currently in the testing phase of an industrial asset tokenization platform, powered by Fabric.

- Northern Trust has invested in crypto startup Zodia custody.

- Novartis uses blockchain to track incorrect or outdated information on pharmaceuticals, along with tracking the black market or counterfeit medicines.

- Oracle has a blockchain-based maritime shipping consortium made up of 300 customers.

- Sappi ensures the sustainability of the pulp they produce, but also everything that is later produced using those materials, with the help of blockchain.

- Swisscom has a total of 11 different blockchain applications, mostly relating to cryptocurrencies.

- Tech Mahindra has a blockchain-based app that helps mobile customers evade spam calls.

- Telefonica uses blockchain to track millions of home equipment devices.

- Walmart’s main use case for the technology is in tracking and detecting food safety issues.

ConsenSys Quorum, based on Ethereum, is also popular with large enterprises looking into using blockchain:

- Ant Group: see above

- Cargill uses the technology to track the movements of different products around the world.

- HSBC: see above

- ING Group: see above

- JPMorgan Chase, where Quorum originated, offers a blockchain network that speeds up interbank transactions, with 425 banks currently signed up for it.

- LVMH is tracking products of luxury brands to fight counterfeits.

- Microsoft manages royalties and content rights with blockchain.

- Novartis: see above

- State Farm handles subrogation through the technology.

While not nearly as popular as the previous two, at least when it comes to these top 50 companies, Corda has still left its mark on the major blockchain platform ground. As each company using Corda is already using one or both of the previous two platforms, we’ve omitted the detailed descriptions of the use cases in question. These companies are:

- Daimler

- Depository Trust & Clearing Corporation (DTCC)

- HSBC

- ING Group

- Novartis

- Swisscom

The days when blockchain was a vaguely understood technology that seemingly only served to power Bitcoin—also a grey zone for many people—are long gone, replaced by the technology’s boom in several major industries. With many of these companies spearheading the research into as many different use cases as possible (sometimes exceeding 50 projects, as we’ve seen), blockchain is already widely considered the best choice for a number of projects.

Lack of Maturity

Myth 7

Blockchain is a relatively new technology. However, it has been around for longer than we think. It has proven its merit in many different use cases.

We will address the maturity of each blockchain we recommend.

ConsenSys Quorum

Although it is now handled by ConsenSys, Quorum was initially developed by JP Morgan. The global leader in financial services announced Quorum in 2016. They developed and launched the platform in 2017.

JP Morgan was initially part of the R3 consortium. They left in 2017 to focus on Quorum. In the same year, they announced interbank payments on the platform. The network-connected more than 300 banks and financial institutions by 2020. The banking giant even developed its own coin, JPM Coin, on top of Quorum. JPM Coin is redeemable at a 1:1 ratio for fiat currency held by JP Morgan. Its purpose is helping instantly transfer funds between the bank’s customers. This does not make it money in the traditional sense. It cannot be spent anywhere, only redeemed for US dollars at JP Morgan.

In August 2020, Ethereum venture ConsenSys acquired Quorum. JP Morgan still uses the platform as a customer of ConsenSys. ConsenSys helps make Quorum, a private blockchain, interoperable with the public Ethereum blockchain.

Recently, ConsenSys partnered with a Chinese government-backed nationwide blockchain project called Blockchain-based Service Network (BSN). This is meant to make Quorum accessible in 80 Chinese cities. Businesses that already use BSN will now have access to Quorum as well. BSN has deployed more than 2,000 blockchain-based apps in China so far.

Hyperledger Fabric

Hyperledger Fabric is the oldest blockchain provider on our list. Founded at the end of 2015, it was first introduced in February 2016. It was designed by IBM for industrial enterprise use. It is now hosted by the Linux foundation.

It has hosted many major projects since its inception. Oracle based its Blockchain-as-a-Service product on Fabric. This offers a less technical approach to implementing blockchain in a business.

Visa developed its B2B Connect product on the same platform in 2019. It offers fast transactions between banks and their business customers. This brings greater security and speed to high amount transactions.

Another recent example is the Brazilian vaccination tracking system. Everyone who gets vaccinated is entered into the blockchain. This means that patients are efficiently tracked. It also offers insight into a patients’ medications for tracking potential side effects.

In the annual Forbes Blockchain 50 list, 24 businesses use Hyperledger Fabric for their projects. These are all enterprises with a revenue of USD 1 billion or more. To learn more about these projects, check out our Blockchain Myths: Mainstream Adoption piece.

All of these examples show that Hyperledger Fabric has come a long way. It is constantly evolving to meet new customers’ needs. High quality technologies are always shifting towards what customers might need.

R3 Corda

The R3 consortium was founded in 2014 to explore distributed ledger technologies. Its founders included Goldman Sachs, Credit Suisse, JP Morgan, and six other banks. Initially, they promised they would raise USD 200 million from their members. In return, the members would get a 90% share in the new blockchain-oriented company they’d found. In 2016, they lowered the amount to USD 150 million and the share to 60%. This caused a few of their members to leave and focus on their own blockchains.

R3’s development of Corda did not slow down, however. Global banking payments network SWIFT integrated with the platform in 2019. That same year, they partnered with MasterCard as well. MasterCard is looking to let customers choose the method by which their funds are moved.

Stock exchange Nasdaq has partnered with R3 in 2020. The goal was to help institutional investors build digital access on blockchain. Corda’s advantage was their experience with tight regulations. This would ensure high quality of service.

Like Quorum, Corda is also integrated into BSN China. Corda lets customers comply with Chinese blockchain regulations. Banks are also very likely to become blockchain users this way. BSN will also offer some decentralized apps (D'Apps) to help familiarize businesses with the concept.

Major blockchain platforms are very well-established. Within a few years, they have onboarded numerous major customers. This has helped them maintain a high standard. They have evolved to suit the needs of enterprise users very well. Chances are they already know how they can help your business. It is very likely they have already encountered similar requirements.

Blockchain is an already established solution implemented by a number of big players across the board, which means you shouldn’t be afraid to consider where it could fit in your own organization. With the worries about energy consumption, speed, data visibility, token use, mainstream use, and maturity now assuaged, you can learn more about its particular strengths by watching our video What Is Blockchain Great At?

Are you ready to adopt blockchain technology?

Our products and services make blockchain technology accessible for everyone

chainlens Blockchain Explorer

SaaS and on-prem blockchain data and analytics platform for Ethereum compatible, layer 2 and Polkadot networks.

Enterprise blockchain support

Production support for public and private blockchain networks built using Quorum and Hyperledger Besu clients.

Web3 Labs Newsletter

With the Web3 industry moving at such a fast pace, it can be time consuming to keep track of all the latest news and events.

Subscribe to our newsletter and you'll receive regular insights and updates relating to enterprise blockchain in one place.